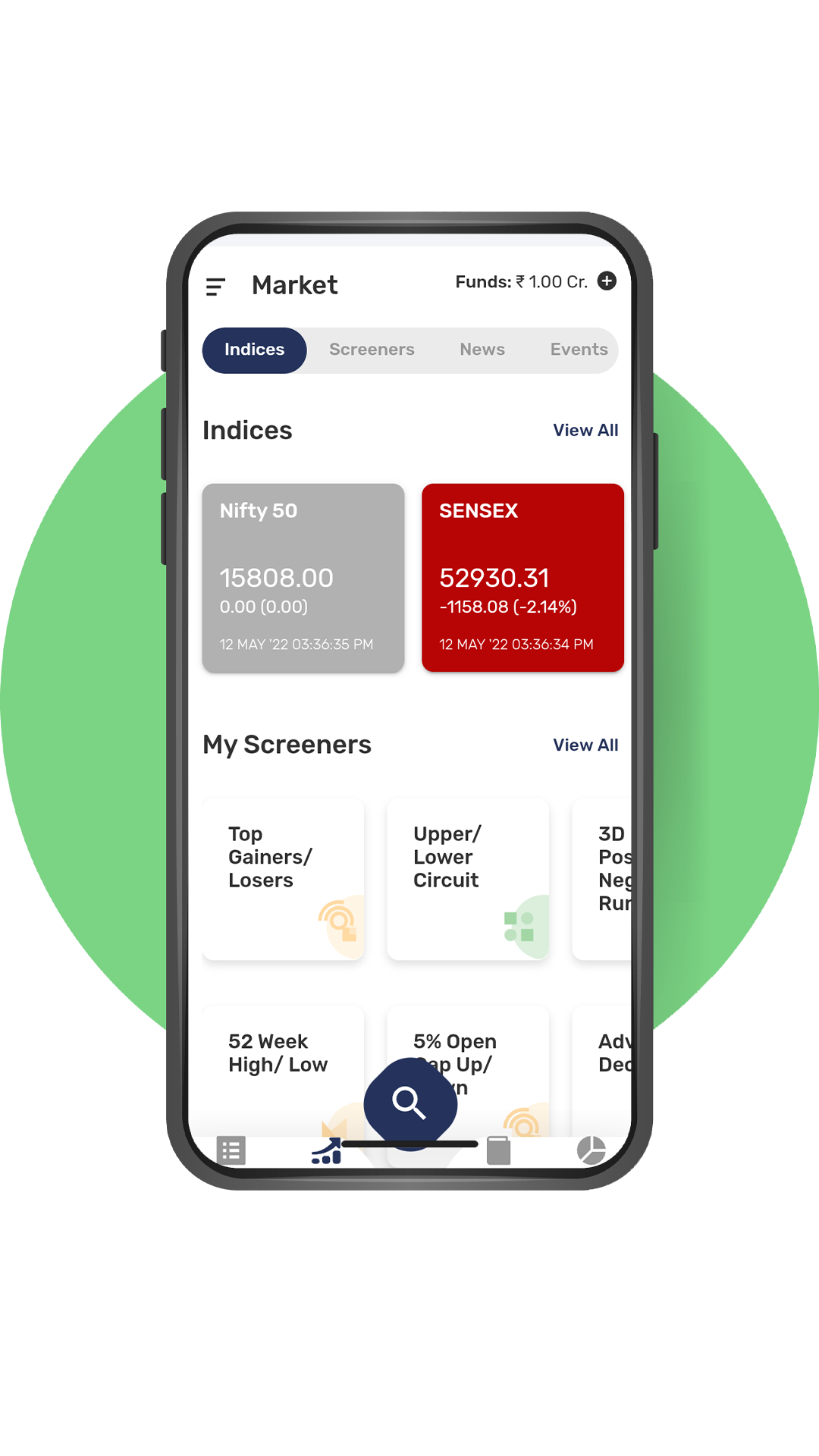

Charting has never been so convenient. Never miss the momentum of the market with inbuilt indicators and advanced charting tools to keep you always updated.

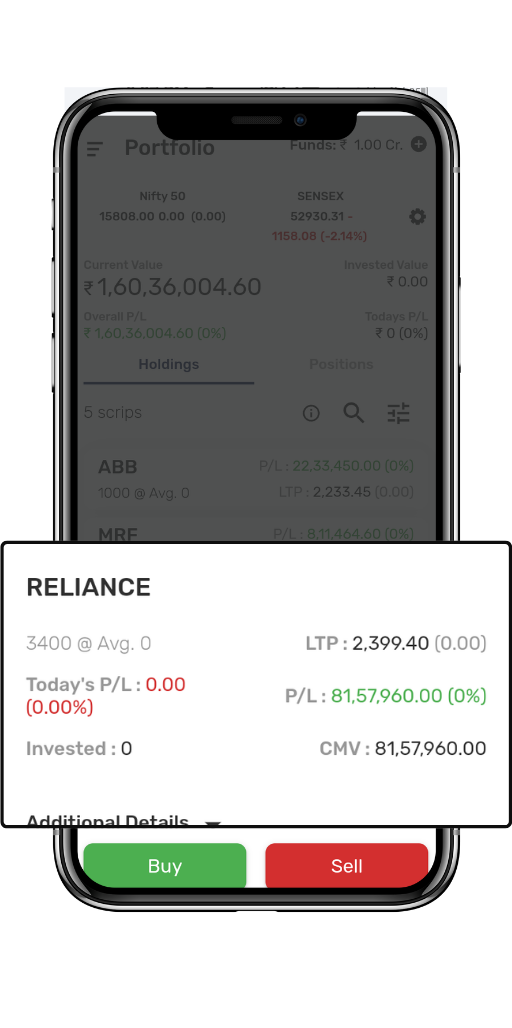

Portfolio’s have been completely redesigned ! You can now track and manage the performance of investments directly from the App with the help of meaningful insights.

We have made subscribing and investing in IPO and Mutual Funds 100% paperless through the mobile app.

“Hindustan Tradecom” is not only an advanced Trading platform but with its Modern approach you get access to all your Profit and loss statements , ledger balance ,limits and many more .

TradingView charts along with ChartIQ on both trading terminal and mobile

Trading & Investment

Trading & Investment Mutual

Funds

Mutual

Funds Government

Security

Government

Security E-IPO

E-IPO ALGO

ALGO Physical Commodity

Physical Commodity Intelligent Portfolio

Intelligent Portfolio Actionable Ideas

Actionable Ideas In-depth Research

In-depth Research Advance Charting

Advance Charting Options Strategy

Options Strategy

Krishi Pragati Award

Valued Member Award

Best Performance in Account Growth

CII Exim Bank Award

Krishi Pragati Award

Valued Member Award

Best Performance in Account Growth

CII Exim Bank Award

Outstanding Participation

(Western India)

Any person who is an individual resident of India, HUF, NRI, proprietary firm, partnership firm, or a company can open a trading account with Hindustan Tradecom Pvt Ltd (HTPL)

It’s simple!

There are four easy ways for opening a power-packed trading account with Hindustan Tradecom:

1) Click on Open an Account

2) Fill up the Online Account Opening form

3) Call 0141-4069600 in case of any queries and our executives will help you fill out the online account opening form

We offer customized brokerage schemes suited to your trading requirements. Hence, the cost depends on the scheme that you choose while opening your trading account with us.

The following are the list of documents required:

3. Bank Pass Book

After you have submitted the relevant documents, we will send you the Welcome Kit with details of your Client Id and password within 2 working days.

If you already have a Demat account with another Depository, simply mention the DPID at the time of account opening and it will be linked to your trading account. No other formalities required.

Client can trade through HTPL lite (exe), and URL based mobile trading.

No, Nomination for Demat Account is an optional facility for client.

POA stands for Power of Attorney in DP account where in beneficial Owner appoint Angel broking as a lawful attorney on behalf of him/her for the purpose of Auto Pay-in of shares to exchange to discharge the settlement obligations in respect of securities sold by him/her or for the purpose of providing margin in respect of trading position taken up by BO. Please refer to the POA form in our KYC application for further details.

Yes, you will get a copy of your account opening application in your online login. If you are opening your account through online porta, Account opening form will be mailed to you upon completion of e-sign.

Yes. It is mandatory to provide valid financial proof to open any derivative segment. You can submit any of the proofs: 6-month bank statement or last 2 ITRs.

Yes, both mobile number and Email ID are mandatory as per SEBI guidelines

402/101, Royal World, Sansar Chandra Road, Jaipur – 302001

For queries & grievance, contact: Vidwan Kanoongo-9928312000,

Email: ig@htplonline.com